10 Dec

Business

The new pandemic has sped up computerized reception among clients, constraining banks and monetary organizations to choose advanced change to digitize their tasks rapidly and proficiently. The circumstance has driven banks and other monetary foundations to digitize the vast majority of their financial activities to take special care of their clients' evolving needs.

The pandemic has likewise molded client assumptions and fulfillment levels. For that reason banks and other monetary organizations must go for an encounter change to meet the developing client assumptions and convey a prevalent CX alongside digitization. As indicated by a new report, 75% of monetary associations name advanced financial change as their first concern for 2021, trailed by client experience enhancements (51%).

Not with standing, to guarantee better CX in this computerized age, monetary organizations and banks trust the presumed suppliers of monetary and banking BPO administrations. These banking BPOs can assist saves money with conveying unrivaled client care and shape their experience. There are multiple ways monetary administrations or banking call focuses can guarantee better CX in this computerized age.

Convey a Seamless Multichannel Experience:

Having a multichannel client commitment methodology has become fundamental in this advanced age. Be that as it may, to help their clients in this momentary time, banks and other monetary organizations should go past the customary multichannel correspondence and spotlight on consistent reconciliation between multichannel touchpoints. An omnichannel supplier of banking BPO administrations can convey an omnichannel client experience across all touchpoints, guaranteeing better consumer loyalty and an expanded consumer loyalty rate.

Help Mobile Selling

As your clients move from actual banking to advanced channels, it brings about your bank losing a few up close and personal deals open doors that occurred at the chiefs' office or the teller's windows. Recreating this experience through web-based channels is really difficult for most banks and credit associations. Much of the time, advanced channels come up short on degree of personalization expected to make the deal conceivable. This is the place where a call community for reevaluating monetary administrations comes to play. With their multichannel and multilingual ability, a call place can convey a customized item offer message to your clients through various correspondence diverts bringing about better transformation. Nonetheless, prior to doing as such, you should foster a logical system for deals utilizing progressed investigation to distinguish the client needs and influence the information to customize an item deals message. As a bigger number of clients today utilize versatile banking than visiting bank offices, the business opportunity is higher in the computerized channels.

Use Insights to Meet Unmet Customer Needs

Using the client knowledge given by your BPO accomplice, as well as cutting edge information investigation and suggestion and application motors, it is feasible to convey customized monetary exhortation to your clients in a simple to-utilize way. With new guidelines and methodologies around open financial APIs, the push toward cutting edge selling will before long become the dominant focal point.

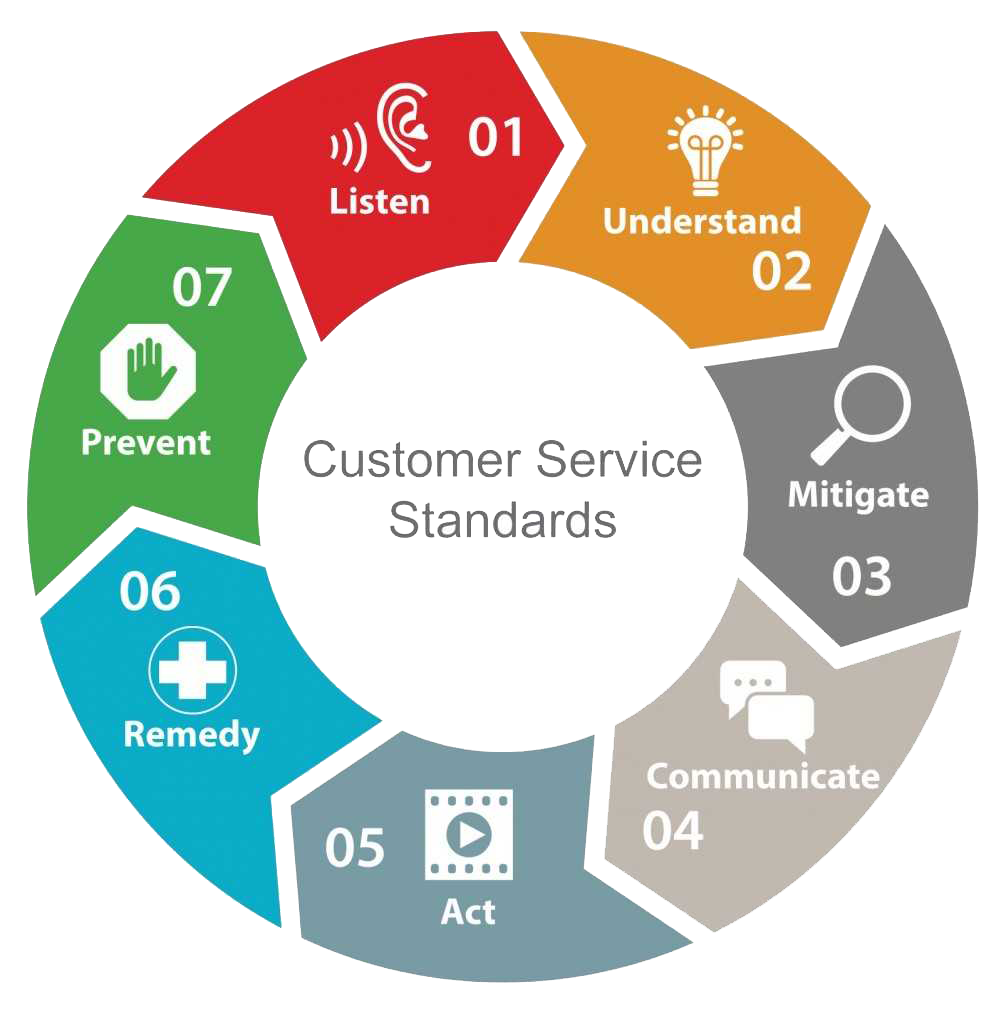

Convey Next-Gen Customer Service

Banks and other monetary foundations should move past customary client care and spotlight on conveying cutting edge client service through advanced change to serve the computerized customer. Here, a call community with a computerized change arrangement can assist you with conveying better client service online by incorporating FAQs and chatbots with cutting edge insight (AI) and AI. The use of IoT innovation in the financial business in conditional capacities and client assistance is likewise a rising pattern in retail banking.

'Future-Proof' Your Company

Beginning around 2008, the financial business has begun moving its concentration from cost decrease to clients. Nonetheless, not having a client driven technique can cost monetary organizations beyond all doubt in this advanced age. In this manner, they need to zero in on conveying the most ideal client experience in advanced and conventional banking. A monetary administrations call focus can assume a huge part in that.

At the point when done right, guaranteeing the appropriate client experience conveyance can bring about cost decrease and expanded incomes. By re-appropriating monetary administrations client service, it is feasible to bring the experience hole and guarantee better maintenance, further developed deals, and better faithfulness - future-sealing your bank.

10 Dec

Business

15 Dec

Business

20 Dec

Business